All Categories

Featured

Table of Contents

- – What resources do I need to succeed with Gener...

- – What are the tax advantages of Policy Loan Str...

- – What type of insurance policies work best wit...

- – Can I access my money easily with Tax-free In...

- – Bank On Yourself

- – How do I track my growth with Generational W...

- – Can I use Infinite Banking for my business f...

Term life is the excellent remedy to a short-term requirement for shielding against the loss of an income producer. There are much fewer reasons for permanent life insurance policy. Key-man insurance policy and as component of a buy-sell contract come to mind as a feasible good reason to purchase an irreversible life insurance coverage plan.

It is a fancy term coined to market high priced life insurance coverage with sufficient payments to the agent and enormous earnings to the insurance coverage firms. Private banking strategies. You can reach the same result as limitless financial with much better outcomes, more liquidity, no danger of a plan gap activating a huge tax obligation issue and more alternatives if you use my options

What resources do I need to succeed with Generational Wealth With Infinite Banking?

Compare that to the predispositions the promoters of infinity banking obtain. 5 Mistakes Individuals Make With Infinite Financial.

As you approach your gold years, economic protection is a top priority. Amongst the several different economic techniques around, you may be listening to more and extra about limitless banking. Bank on yourself. This concept enables nearly anybody to become their own bankers, using some benefits and adaptability that could fit well right into your retired life strategy

What are the tax advantages of Policy Loan Strategy?

The finance will certainly accrue straightforward interest, yet you maintain versatility in setting payment terms. The rates of interest is also traditionally less than what you 'd pay a conventional financial institution. This type of withdrawal enables you to access a portion of your cash money value (as much as the amount you have actually paid in costs) tax-free.

Lots of pre-retirees have worries concerning the safety of boundless financial, and permanently reason. While it is a legitimate approach that's been embraced by individuals and businesses for several years, there are threats and disadvantages to take into consideration. Unlimited financial is not an ensured method to build up riches. The returns on the cash money worth of the insurance coverage may fluctuate depending upon what the marketplace is doing.

What type of insurance policies work best with Cash Value Leveraging?

Infinite Financial is a monetary approach that has gotten considerable attention over the past few years. It's an unique method to handling personal finances, enabling people to take control of their money and produce a self-reliant banking system - Cash value leveraging. Infinite Financial, also understood as the Infinite Banking Concept (IBC) or the Count on Yourself method, is a monetary strategy that includes using dividend-paying whole life insurance policy plans to create an individual financial system

To comprehend the Infinite Financial. Idea method, it is consequently crucial to provide a summary on life insurance policy as it is a very misunderstood possession class. Life insurance policy is an important part of financial planning that supplies lots of benefits. It is available in numerous shapes and dimensions, one of the most usual types being term life, entire life, and universal life insurance policy.

Can I access my money easily with Tax-free Income With Infinite Banking?

Let's explore what each type is and just how they vary. Term life insurance coverage, as its name recommends, covers a details duration or term, typically in between 10 to thirty years. It is the most basic and usually the most cost effective kind of life insurance policy. If the insurance holder passes away within the term, the insurer will pay the survivor benefit to the assigned recipients.

Some term life plans can be renewed or converted into an irreversible plan at the end of the term, but the costs normally increase upon revival as a result of age. Whole life insurance policy is a kind of long-term life insurance policy that offers coverage for the insurance holder's whole life. Unlike term life insurance coverage, it includes a cash money value part that expands with time on a tax-deferred basis.

It's crucial to bear in mind that any kind of impressive car loans taken against the plan will certainly reduce the death advantage. Entire life insurance policy is usually extra costly than term insurance policy because it lasts a life time and builds cash money value. It likewise uses foreseeable costs, indicating the price will not enhance with time, giving a level of assurance for policyholders.

Bank On Yourself

Some factors for the misconceptions are: Intricacy: Entire life insurance policy plans have more elaborate functions compared to label life insurance, such as cash money worth accumulation, returns, and plan loans. These functions can be challenging to understand for those without a history in insurance or individual money, bring about confusion and mistaken beliefs.

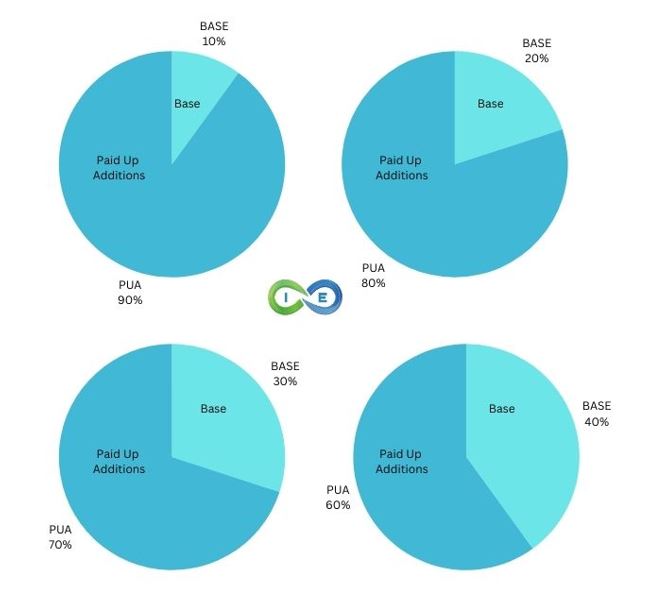

Bias and false information: Some individuals may have had unfavorable experiences with whole life insurance coverage or listened to stories from others that have. These experiences and anecdotal details can add to a prejudiced sight of entire life insurance policy and bolster misunderstandings. The Infinite Financial Idea method can only be implemented and executed with a dividend-paying entire life insurance policy policy with a common insurance provider.

Whole life insurance is a kind of long-term life insurance that supplies coverage for the insured's entire life as long as the premiums are paid. Entire life plans have 2 primary components: a death benefit and a cash money worth (Generational wealth with Infinite Banking). The death advantage is the amount paid to recipients upon the insured's fatality, while the cash money value is a cost savings component that grows over time

How do I track my growth with Generational Wealth With Infinite Banking?

Reward payments: Shared insurance provider are possessed by their insurance holders, and as an outcome, they may disperse earnings to insurance holders in the form of rewards. While rewards are not guaranteed, they can help enhance the money value growth of your policy, enhancing the general return on your resources. Tax obligation benefits: The money value growth within a whole life insurance plan is tax-deferred, implying you do not pay tax obligations on the growth up until you withdraw the funds.

Liquidity: The cash money value of a whole life insurance plan is very fluid, allowing you to gain access to funds easily when required. Possession protection: In several states, the cash worth of a life insurance plan is shielded from lenders and claims.

Can I use Infinite Banking for my business finances?

The policy will certainly have immediate cash money worth that can be positioned as security 30 days after funding the life insurance policy plan for a revolving credit line. You will certainly be able to access through the rotating credit line as much as 95% of the readily available cash worth and utilize the liquidity to fund a financial investment that gives income (cash circulation), tax obligation advantages, the opportunity for recognition and leverage of other individuals's capability, abilities, networks, and funding.

Infinite Financial has actually ended up being very popular in the insurance policy world - also a lot more so over the last 5 years. R. Nelson Nash was the maker of Infinite Banking and the company he established, The Nelson Nash Institute, is the only organization that formally accredits insurance agents as "," based on the following standards: They line up with the NNI requirements of professionalism and trust and values (Whole life for Infinite Banking).

They efficiently complete an instruction with a senior Licensed IBC Expert to ensure their understanding and ability to use every one of the above. StackedLife is Authorized IBC in the San Francisco Bay Location and works nation-wide, helping clients recognize and implement The IBC.

Table of Contents

- – What resources do I need to succeed with Gener...

- – What are the tax advantages of Policy Loan Str...

- – What type of insurance policies work best wit...

- – Can I access my money easily with Tax-free In...

- – Bank On Yourself

- – How do I track my growth with Generational W...

- – Can I use Infinite Banking for my business f...

Latest Posts

Bank On Yourself For Seniors

Understanding The Basics Of Infinite Banking

Nelson Nash Whole Life Insurance

More

Latest Posts

Bank On Yourself For Seniors

Understanding The Basics Of Infinite Banking

Nelson Nash Whole Life Insurance